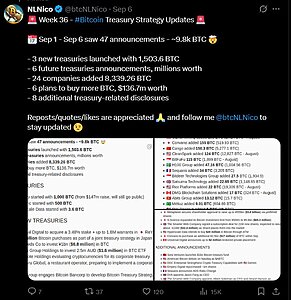

This week marked a major milestone in the world of digital finance as corporate Bitcoin treasuries collectively surpassed one million BTC. Between September 1 and September 6, companies announced fresh allocations totaling nearly 9,800 BTC, valued at close to $1 billion. This surge reflects growing confidence in Bitcoin as a strategic reserve asset.

New Entrants and Expanding Strategies

Three new corporate treasuries were launched during the week. A Dutch firm entered the space with 1,000 BTC, funded by a $147 million round. CIMG Inc, listed in China, began with 500 BTC, while Hyperscale Data in the United States started with 3.6 BTC. These newcomers contributed a combined 1,503 BTC.

Momentum continued with future plans from global firms. Universal Digital from Canada announced a $100 million Bitcoin initiative in Japan. Japanese company Star Seeds Co committed ¥1 billion, and Australia’s InFocus Group allocated 2.5 million AUD for a Bitcoin ETF. Other firms including FiscalNote Holdings, Yoshiharu Global, and Sadot Group revealed intentions to adopt Bitcoin treasury strategies.

Existing Firms Deepen Their Bitcoin Exposure

Established players aggressively expanded their holdings. Strategy, led by Michael Saylor, added significantly to its position, now holding over 636,500 BTC. Marathon Digital acquired 1,838 BTC, Metaplanet added 1,009 BTC, and American Bitcoin increased its reserves by 502 BTC.

Smaller additions came from Cipher Mining with 195 BTC, CleanSpark with 124 BTC, and Convano with 155 BTC. Cango acquired 150 BTC, while other firms such as Sequans, Bitdeer Technologies, and DMG Blockchain Solutions made modest contributions. In total, 24 companies added 8,339 BTC during the week.

Frequently Asked Questions (FAQs)

- What is the significance of crossing one million BTC in corporate holdings?

It marks a turning point in Bitcoin’s role as a mainstream treasury asset, reflecting institutional trust and long-term strategic value.

- Which company holds the most Bitcoin?

Strategy Inc leads with over 636,500 BTC, making it the largest corporate holder globally.

- Are more companies planning to adopt Bitcoin?

Yes, firms across Canada, Japan, Australia, and the United Kingdom have announced future allocations and expansion plans, signaling continued growth.