The cryptocurrency market is experiencing a strong upward trend today, with green dominating across major tokens. Investor sentiment has turned bullish, driven by a combination of institutional activity and key developments. Among the most influential factors are Donald Trump’s pro-Bitcoin stance, updates in the XRP lawsuit, and broader macroeconomic shifts.

Market Cap Jumps by $113 Billion Amid Token Rally

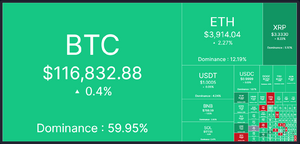

Led by Bitcoin, Ethereum, and XRP, the overall crypto market has added $113 billion in value, reaching a total market capitalization of $3.87 trillion. This marks a 3 percent increase in a single day. Trading volume has also surged, climbing 44 percent to $180.95 billion, indicating heightened investor interest and activity. CoinMarketCap’s heatmap reflects widespread gains, with nearly all digital assets contributing to the rally.

Key Drivers Behind Today’s Crypto Rally

Institutional and retail investors are fueling today’s market momentum. A major catalyst is President Donald Trump’s newly signed executive order permitting cryptocurrencies in 401(k) retirement plans. Additionally, his nomination of Bitcoin advocate Stephen Miran to the Federal Reserve has boosted investor confidence.

Bitcoin has also benefited from strong inflows into U.S. Spot Bitcoin ETFs, with over $280 million added on August 7 alone. As a result, Bitcoin’s price has risen by 2 percent, currently trading at $116.7k.

Ethereum’s surge is supported by SharpLink Gaming’s $200 million investment in ETH and continued whale accumulation. ETH has climbed 5 percent and is approaching the $4k level.

XRP Lawsuit Resolution Sparks Optimism

One of the most impactful developments is the conclusion of the XRP lawsuit. With the final appeal dismissed, XRP now enjoys regulatory clarity. Speculation around BlackRock launching an XRP ETF has further boosted sentiment. XRP is trading at $3.33, up 12 percent in the past 24 hours.

Favorable Macroeconomic Conditions Support Growth

Broader economic factors are also contributing to the rally. The likelihood of a Federal Reserve interest rate cut in September stands at 89.4 percent, while the Bank of England has implemented a 25 basis point reduction. Technical indicators show the market cap holding above key moving averages, reinforcing the bullish trend.

Frequently Asked Questions (FAQs)

- What does Donald Trump’s executive order mean for Bitcoin?

Donald Trump’s newly signed executive order permits cryptocurrencies, including Bitcoin, to be included as eligible assets in 401(k) retirement investment plans.

- How has XRP reacted to the lawsuit resolution?

Following the conclusion of its legal battle, XRP has jumped 12 percent in value today, reflecting renewed investor confidence and regulatory clarity.

- What macroeconomic trend is boosting the crypto market today?

The increasing likelihood of a U.S. interest rate cut in September is fueling optimism across the crypto market, acting as a key driver of today’s rally.