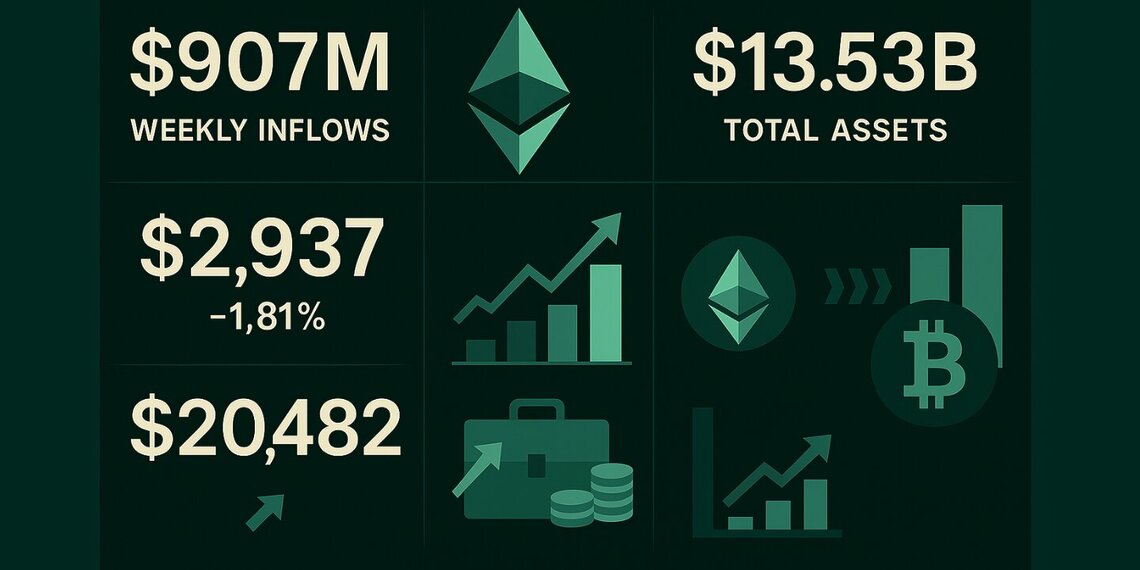

This week marked a record-breaking performance for Ethereum ETFs, with net inflows topping $907 million and overall assets reaching $13.53 billion, a sign of growing market confidence. According to data from SoSoValue, the inflow chart mirrored some of the highest historical activity, with a peak daily injection of $204.82 million.

After a sluggish start to 2025 marked by negative net flows in Q1, Ethereum ETFs have rebounded sharply over the past two months. ETF analyst Nate Geraci highlighted that three of this week’s inflows rank among the top 10 largest ever recorded.

Despite the unprecedented fund movement, ETH’s price dipped slightly to $2,937, down 1.81% in the last 24 hours. Analysts suggest macroeconomic factors may be dampening price momentum for now.

Ethereum ETFs are increasingly drawing comparisons to Bitcoin ETFs. SoSoValue data shows a narrowing gap, hinting at a shift in investor interest toward Ethereum’s staking capabilities. Although price movement remains muted, ETF-driven accumulation could eventually constrict supply and propel a breakout—especially if broader conditions stabilize.

Notably, BlackRock’s ETHA ETF achieved a milestone by holding 2 million ETH valued at $300 million as of July 10. Meanwhile, SharpLink Gaming continues expanding its Ethereum reserves, with a recent $90 million purchase underscoring the trend.