Listed Bitcoin mining companies resumed BTC sales in March, breaking away from the strong HODL trend observed in preceding months. This marked the highest monthly liquidation rate since October 2024.

Summary

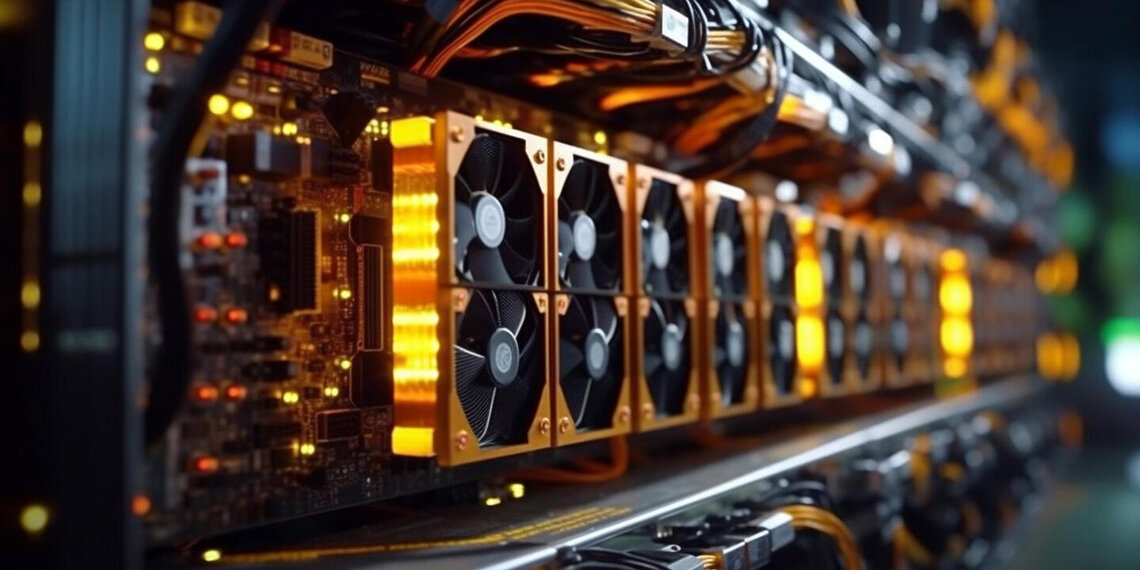

Bitcoin mining farms restart BTC reserve sales: a bearish indicator?

As reported, publicly traded Bitcoin mining companies appear to have resumed BTC sales starting in March 2025.

This marks a significant shift from the strong HODL strategy adopted during the months of the presidential elections amid the BTC bull run.

Notably, around 15 publicly listed mining companies collectively sold over 40% of their total BTC production last month.

CleanSpark, a prominent U.S.-based Bitcoin mining company, has officially announced a change in its BTC HODLing strategy, which had been in place since mid-2023.

Regarding this, CleanSpark’s CEO, Zach Bradford, commented:

“With our Bitcoin holdings exceeding 12,000, valued at approximately 1 billion dollars, we believe it is the right time to evolve from the nearly 100% holding strategy adopted in mid-2023 and return to using a portion of our monthly production to support operations. This represents a significant strategic distinction compared to many of our peers, who continue to rely on share dilution to finance operational costs or on increasing leverage to grow Bitcoin reserves.

We consider our approach deliberately strategic rather than ideological, especially now that we have reached our current size. While remaining committed to Bitcoin as a long-term asset, we believe that a more effective way to increase shareholder value is a balanced approach between monetizing new production and building long-term holdings.”

Other companies like HIVE, Bitfarms, and Ionic Digital have already sold more than 100% of their March BTC production.

Bitcoin Mining: publicly traded companies abandon their BTC HODLing strategy.

The shift from HODLing BTC to selling it suggests that miners may be responding to shrinking profit margins caused by low hash prices and the growing uncertainty linked to the trade war.

Additionally, this resurgence in Bitcoin sales by publicly traded mining companies marks the highest monthly liquidation rate since October 2024.

Back in October, similar liquidation peaks were recorded; however, sales tapered off as BTC prices climbed towards the end of the year.

With Bitcoin’s hash price hovering near cycle lows and block transaction fees down to 1.1%, mining companies seem to be leaning on their BTC reserves once again to sustain operations and strengthen liquidity.

This surge in BTC sales could also reflect increased capital expenditure needs within the sector. Numerous large mining firms have announced plans for infrastructure expansion, ASIC upgrades, and diversification into high-performance computing, all of which require substantial capital in a more challenging post-halving environment.

Arizona makes strides in regulatory developments.

Recently, discussions surrounding Bitcoin mining have highlighted the Arizona Senate’s approval of the HB 2342 law designed to safeguard miners.

With a vote of 17 in favor and 12 against, the law now awaits final approval from the governor.

HB 2342 specifically aims to shield individuals who engage in BTC mining or operate blockchain nodes at home from zoning and usage restrictions imposed by cities and counties.

In Arizona, the focus is less on companies and more on ensuring individuals’ freedom to pursue mining activities without interference from local governments.