Ripple is drawing renewed attention for its aggressive expansion across the digital asset landscape, especially following new details revealed in Gemini’s IPO filing. Omar, a crypto investor at Dragonfly, described Ripple as evolving into a “full-stack financial services firm,” with XRP playing a central role in its ecosystem.

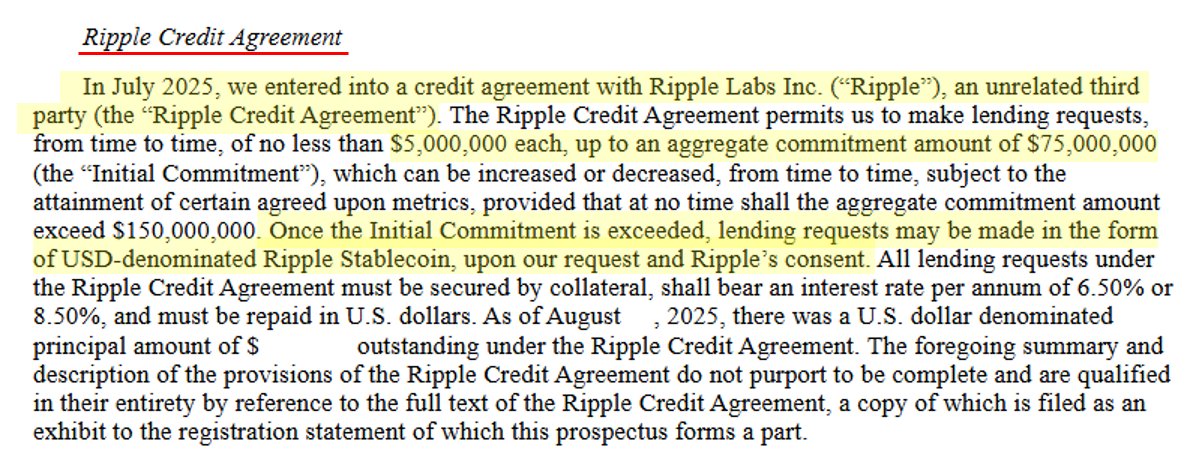

The IPO filing disclosed a credit agreement between Ripple and Gemini, allowing Gemini to request loans starting at $5 million, up to a total of $75 million. Notably, once the initial commitment is surpassed, Gemini can request loans in Ripple’s USD-denominated stablecoin, pending Ripple’s approval. The agreement also sets a maximum lending cap of $150 million, signaling Ripple’s readiness to deploy capital at scale.

Omar emphasized that Ripple is integrating lending, payments, and token infrastructure into a unified model, with XRP at its core. The Gemini deal offers a rare glimpse into Ripple’s broader strategy to build a comprehensive financial stack.

Strategic Acquisitions Strengthen Ripple’s Ecosystem

Ripple’s recent acquisitions further highlight its ambitions. The company purchased Rail, a payment service provider, for $200 million to improve the real-world utility of XRP and RLUSD. This move enhances Ripple’s ability to connect digital assets with global payment systems, offering institutions better access to liquidity.

Ripple also acquired Hidden Road, a brokerage firm specializing in digital asset services, including prime brokerage. These developments, combined with XRPL’s EVM integration, allow institutions to trade, borrow, settle, and tokenize within Ripple’s expanding ecosystem.

XRP’s Price Outlook and Market Impact

Ripple’s strategic moves are expected to influence XRP’s market performance. Analysts, including Ali Charts, have speculated that XRP could rally to $3.60, driven by Ripple’s growing partnerships and infrastructure. By consolidating services across lending, payments, and brokerage, Ripple is positioning itself to compete with traditional financial institutions.

As Ripple continues to build out its financial stack, XRP stands to benefit from increased utility and institutional adoption.

Frequently Asked Questions (FAQs)

- What is Ripple’s credit agreement with Gemini?

Ripple allows Gemini to borrow up to $150 million, including options to request loans in Ripple’s stablecoin.

- How does Ripple’s acquisition of Rail impact XRP?

It boosts XRP’s real-world transaction capabilities by linking it to global payment systems.

- Could Ripple’s strategy affect XRP’s price?

Yes, analysts believe Ripple’s expansion could drive XRP’s value higher due to increased utility and demand.